Being a leader in the area of sustainability is a long-standing ambition for Santander CIB. To accomplish this key goal, a strong and sustainable global offering is essential in order to partner with our clients to help them in their transition towards a more responsible, social and environmentally sustainable (ESG) model. Moreover, Santander CIB's contribution is key to fulfilling Santander’s recent commitments to achieving net zero carbon emissions across the group by 2050.

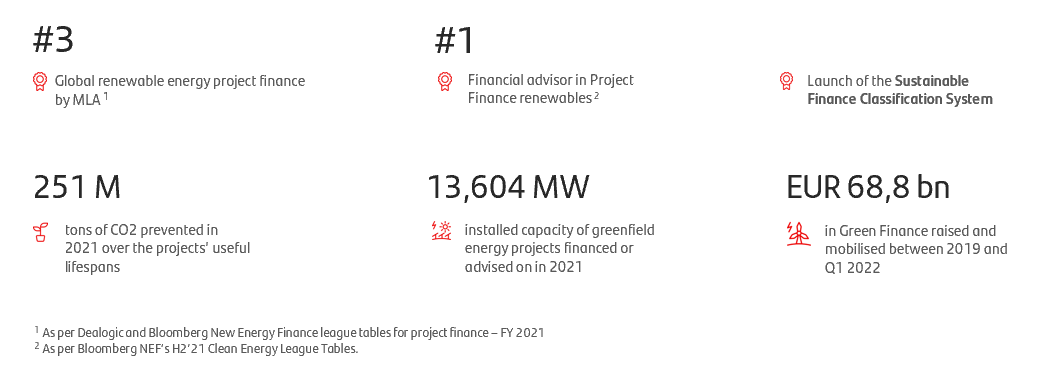

Santander’s goal is to build a more responsible bank and it has made a number of commitments to support this objective, including raising over €120 billion in green finance between 2019 and 2025. This figure will increase to €220 billion in 2030 and includes the Group's overall contribution to green finance: project finance, syndicated loans, green bonds, capital and export finance, advisory and other products.

Leveraging on a solid track record in renewable energy and strong product capabilities across our platform, we are now moving towards fully-integrated ESG solutions, serving an increasing appetite from corporate and institutional customers. To better support our customers in achieving their own ESG objectives, in 2020 Santander CIB created a dedicated team to boost its sustainable finance proposition. This new global team works closely with product teams, such as Global Transaction Banking, Project Finance and Markets, to provide strategic solutions as well as product and financing structures tailored to specific industries, geographies and market sectors, helping our customers in their transition towards a more sustainable business model.