How supply and demand will shape the raw materials ecosystem

Industrialisation and subsequent rising prosperity throughout the 20th century have been intrinsically linked with fossil fuel usage. However, breakthroughs in the realm of robotics, data transition networks & storage, and economies decarbonization, will likely move the focus to achieve growth targets and to stick to environmental commitments.

Limited supply and geographical concentration of certain resources creates an ecosystem in which certain countries or regions become key players in the global supply chains for specific products or sectors.

This hasn’t gone unnoticed by governments, either. Over the last few years, the importance placed on certain key raw materials has skyrocketed. Europe, for instance, has been working on developing comprehensive metal sourcing strategies; the Critical Raw Materials Act of the European Commission is a good example of attempts to enhance supply chain resilience and decrease dependence on the raw material industry as a whole.

Strategic and critical raw materials

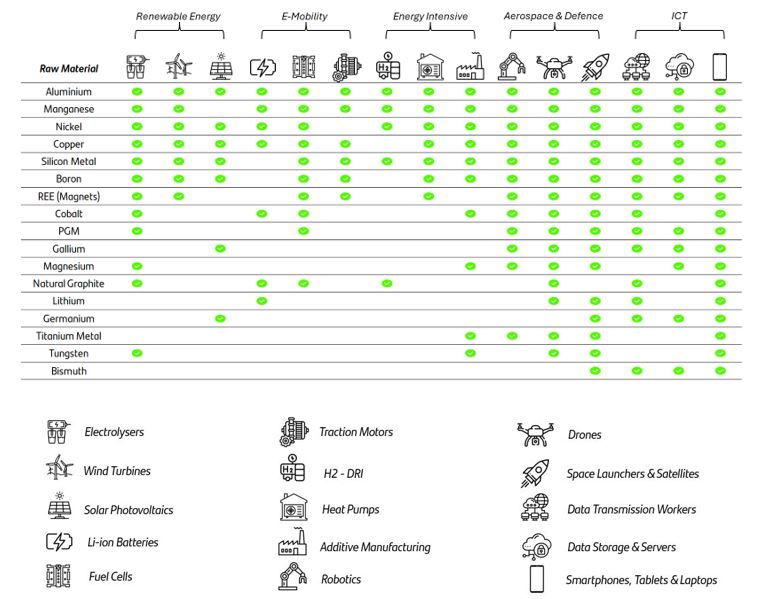

Raw materials are fundamental in the successful fulfilment of key governmental initiatives, with the European Union a prime example.

The failure to achieve a resilient supply of such resources has the potential to create a cascade effect, in turn negatively impacting a myriad projects and objectives on the agenda.

Such initiatives are spread across a huge range of sectors, bringing into focus the value and scarcity of precious resources.

Below you can find a more detailed overview of raw materials’ importance across 15 key technologies. Selections have been based on:

- Further expansion for energy and digital transformation

- Likely growth of emerging technologies

- Relevance to EU security

European Critical Raw Materials Act

Considering the aforementioned importance of so many raw materials, one must examine how legislation aims to maintain resiliency and diversification, particularly with reserves of so many spread far across the planet.

A good case study for this is the European Critical Raw Materials Act, which was provisionally agreed in November 2023, aiming to increase and diversify raw materials supply, strengthen circularity and support research and innovation on resource efficiency.

Within the Act comes a number of benchmarks, in order to establish rules for the environmental footprint of critical raw materials, as well as their sourcing, along the value chain and for diversification of EU supplies by 2030:

- At least 10% of the EU’s annual consumption for extraction

- At least 40% of the EU’s annual consumption for processing

- At least 25% of the EU’s annual consumption for recycling

- No more than 65% of the EU’s annual consumption from a single third country

Global policymaking and the role of climate projects on raw material supply

With the deployment of renewable energy technologies comes the expectant result of strong demand pull for several key resources. This demand could be hard to meet with the available primary and secondary supply – the latter being derived from recycling resources.

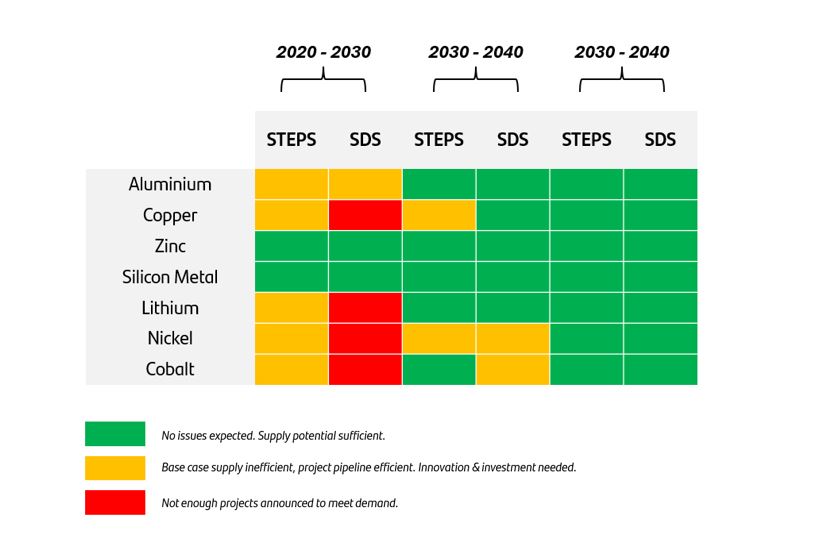

See how supplies are shaping up over the next couple of decades across two distinct policy outlooks, as per KU Leuven:

- Stated Policies Scenario (STEPS)

- Sustainable Development Scenario (SDS)

This expected scarcity of supply could lead to increased commodity prices.

Actions to reduce metal demand could also be deployed, such as technological innovation and substitution to reduce and optimise metal intensities in existing clean energy technologies, among others.