Santander has cemented its leadership in sustainable investment in Spain by launching its first bond for retail customers under Environmental, Social and Governance (ESG) criteria. The product has a 90% guaranteed principal and presents customers with the chance to invest in profitable projects that have a positive social impact, with as little as €5,000.

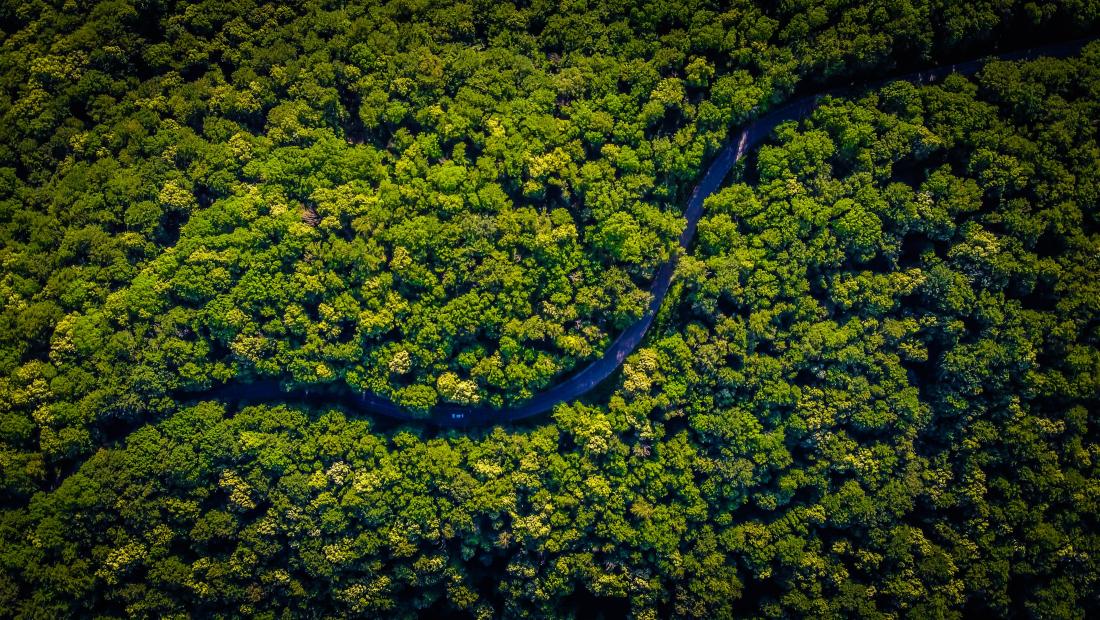

With a three year maturity, the bond’s yield is pegged to the performance of the Eurostoxx 50 ESG-X index. The funds raised from this product, developed by Santander CIB, and marketed through the bank’s branch network, will fund Santander-managed projects like wind and solar farms that meet its socially responsible criteria.

The product is part of the bank's global sustainable emissions plan, which will finance green, social and sustainable activities under its responsible banking initiatives. An annual report will detail the use of the funds and their impact.

Santander CIB maintains a firm commitment to sustainability and to the objective set by Banco Santander of providing more than 120,000 million euros in green financing by 2025, a figure that will rise to 220,000 million until 2030. As an example of this, Santander CIB has reinforced its capabilities with a team dedicated to ESG advice.

An annual report will be published detailing the use of the funds and the impact the financing offered is having.

Santander CIB issued its first green bond for institutional investors in October 2019 in a €1 billion transaction. According to the report published today, 32 solar and photovoltaic projects with an installed capacity of more than 6,300 megawatts (MW) were financed through the deal. Based on Santander's stake in the financing of these projects, emissions will be cut to the equivalent of 700,000 homes’ yearly carbon dioxide (CO2) consumption. In June, Santander issued another green bond – a senior non-preferred bond – that raised €1 billion.